Advanced Pricing Methods℠ (APM) is a term I coined to encompass techniques that I teach professionals to use to price knowledge work before the ...

Several years ago, it hit me that the root cause of much tension among firm's leaders is the fact that, in our profession, we're trying to ...

Are you trying to grow too many vertical niches* at once? As CPA firms make the wise move from "generalist" practices to "specialists," many ...

I keep reading how buyers across all sectors are "demanding discounts" and it's easy to see how this creates strain and pressure for us to do ...

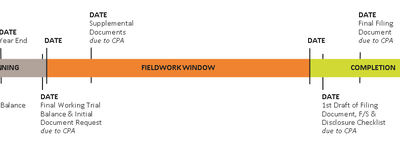

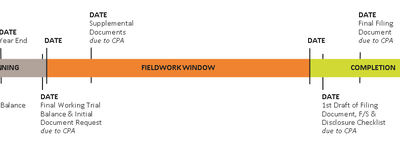

When clients haven't done their part to be ready, many CPAs feel compelled to pitch in and "help" the client anyway. But in doing so without a ...