You work hard to deliver meaningful results, not just services. But no matter how qualified or experienced you are, some buyers will treat you ...

There are far too many variables for firm-to-firm comparisons to be meaningful. Even within the same firm, many factors affect success. To ...

Advanced Pricing Methods℠ (APM) is a term I coined to encompass techniques that I teach professionals to use to price knowledge work before the ...

What is a "value price"? Is it the same as a "worth-based price"? Can either of those be a "subscription price"? And what does Advanced Pricing ...

Firm operations rockstar Jane Johnson was honored by CPA Firm Management Association as their 2021 Firm Manager of the Year. Jane is the COO of ...

Several years ago, it hit me that the root cause of much tension among firm's leaders is the fact that, in our profession, we're trying to ...

Are you trying to grow too many vertical niches* at once? As CPA firms make the wise move from "generalist" practices to "specialists," many ...

I keep reading how buyers across all sectors are "demanding discounts" and it's easy to see how this creates strain and pressure for us to do ...

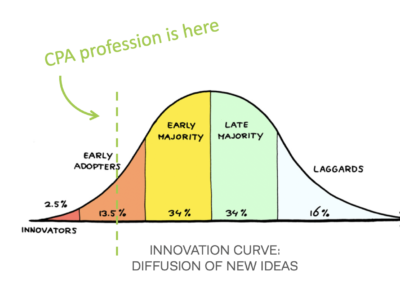

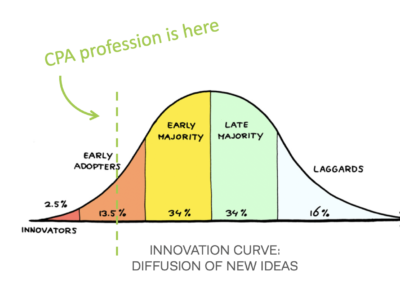

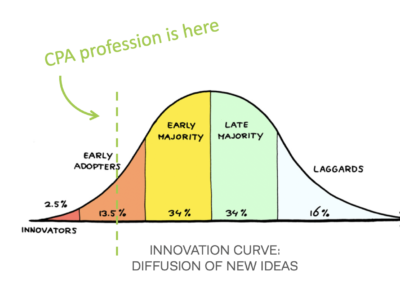

We're seeing some really big strides in the business (and revenue) model shifts in the accounting profession. At this writing, FIVE of the US ...

Embarking on a business model change? If you're looking for alternatives to billing by the hour, you're looking at more than a revenue model ...

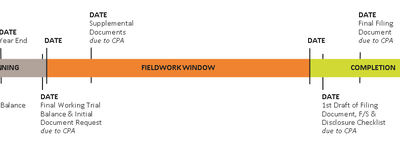

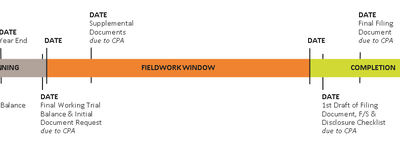

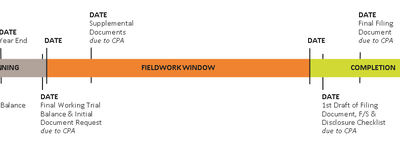

When clients haven't done their part to be ready, many CPAs feel compelled to pitch in and "help" the client anyway. But in doing so without a ...

My friend Gale Crosley kindly featured my article, "Are You Ready to Change Your Pricing Model Yet?" in her Business Discipline of Practice ...