Advanced Pricing Methods℠ (APM) is a term I coined to encompass techniques that I teach professionals to use to price knowledge work before the ...

What is a "value price"? Is it the same as a "worth-based price"? Can either of those be a "subscription price"? And what does Advanced Pricing ...

I keep reading how buyers across all sectors are "demanding discounts" and it's easy to see how this creates strain and pressure for us to do ...

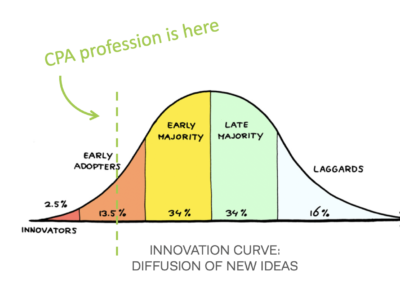

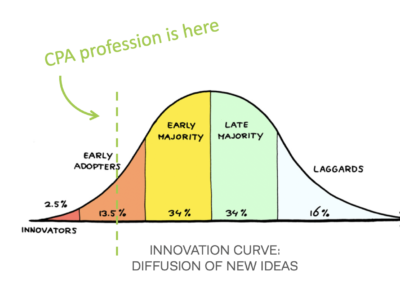

We're seeing some really big strides in the business (and revenue) model shifts in the accounting profession. At this writing, FIVE of the US ...

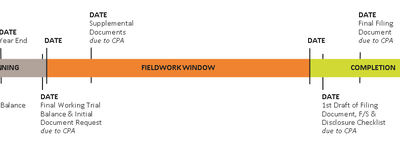

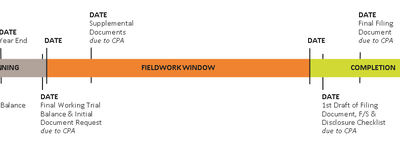

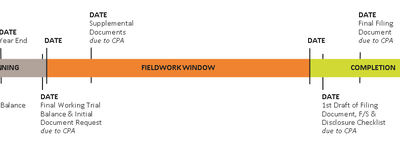

When clients haven't done their part to be ready, many CPAs feel compelled to pitch in and "help" the client anyway. But in doing so without a ...

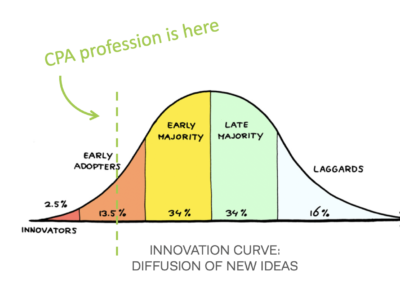

My friend Gale Crosley kindly featured my article, "Are You Ready to Change Your Pricing Model Yet?" in her Business Discipline of Practice ...

This week's Accounting Today podcast features a 19-minute interview of Michelle Golden by awesome editor-in-chief, Dan Hood.

In the podcast, ...

By admin | November 1, 2017 | News, Pricing Strategies With Flat Organic Growth, and Amid Forecasts of Shrinking Compliance Revenue, CPAs Seek Alternatives to Billing for Time

Oct 30, 2017 – Santa ...