Several years ago, it hit me that the root cause of much tension among firm’s leaders is the fact that, in our profession, we’re trying to operate multiple business models simultaneously without acknowledging some key distinctions among our models. In addition to causing frustration, the fact is, we cannot be fully successful at operating different models if we approach operating and measuring them exactly the same way!

Today, business model transformation is a very hot topic with many firms readily embarking on making some big changes. As such, it’s the perfect opportunity to figure out where these tensions occur and how to address them in your overall transformation efforts. I’m a big believer in getting on the same page about how the organization defines certain words or phrases so they can have greater understanding and alignment of what, exactly, we mean when we say “x.” Perhaps this post can help you as your firm defines “business model.”

Defining “business model”

A business model is how a company generates value for buyers. “Business model” includes a company’s revenue models (how the company generates income: hourly, fixed pricing, subscription, and more). However, revenue is only one of nine elements of the business model. The nine elements are: Value Proposition, Customer Segments, Customer Relationships, Distribution Channels, Key Activities, Key Partnerships, Key Resources, Revenue Streams & Models, and Cost Structure. (Note that cost structure is NOT a revenue model. And then there’s the corollary that cost is NOT a price.)

Accounting firm business models

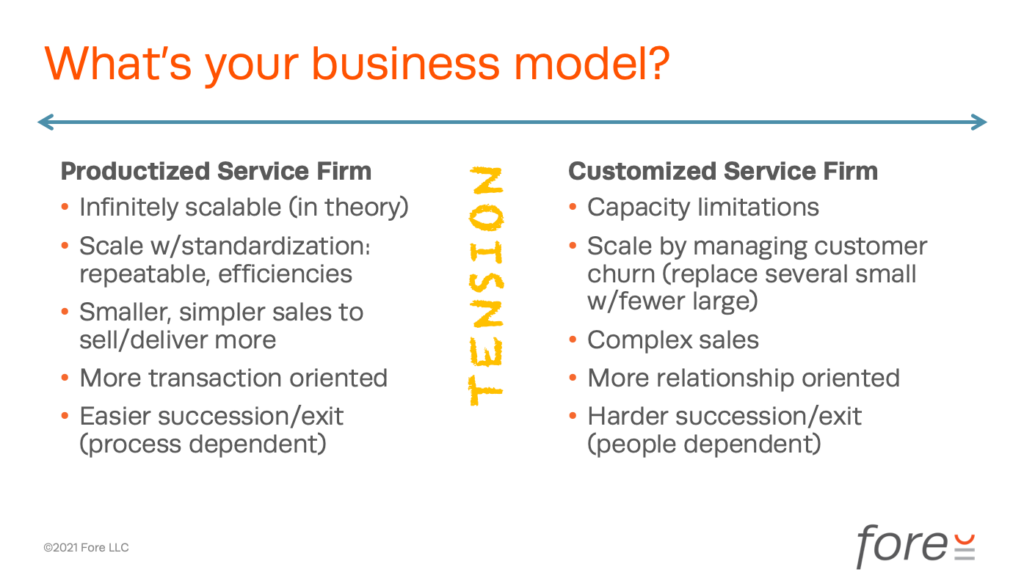

Currently, in the accounting profession, we use two distinct business models (think of them in part as people dependent vs process dependent). First, there’s the highly leverageable “productized service” (transactional) model which typically has a high volume of buyers and a smaller per-sale size. Ideally, this is a recurring revenue stream—perfect for a subscription model. Second, there’s the much less scalable “customized service” (consulting/advisory) model. This model has fewer, larger-sale-value buyers and tends to be one-off sales.

There are trade-offs to each model. With the productized model, the buyer pays a lower price to get your “good” (non-custom) service, so to make more money, you must add volume and maximize efficiency. I say “good” because “perfect” would mean customizing every time, and buyers are often willing to pay less to get “good” as opposed to “perfect.” Thus finding your standardized “good” at the right price point is sweet spot to pursue with this model.

In the customized product model the buyer pays a premium price for a tailored service. This is, by definition, less efficient so you need to charge more and serve fewer buyers. There are plenty of buyers willing to pay for this, especially when you are a perceived specialist in your service area AND within their industry sector. That’s the “worth” sweet spot for this model.

CPA firms have a gaping wound. They frequently try to customize at the same time they try to productize. More on that in a moment.

Can you run multiple business models at the same time?

A business can successfully operate different business models at the same time. But beware: don’t expect to operate them the SAME WAY. This is where most of our firms get it wrong at first.

The two typical CPA-firm models above require distinctly different skillsets, value propositions, go-to market strategies, cost structures, KPIs, and management practices, thus are vastly different business models. Where we get into trouble is that we frequently mix the models.

In management meetings, we say we want (and we reward) “standardized” yet we constantly customize. To be customer-friendly, we say we want customized and we want to be “true business advisors” yet we force people into metrics and KPIs that suit a standardized model. Have you been in these meetings? I have and they aren’t pleasant.

Maximize your different business models

Instead, the team for each service you deliver would “pick one” model they operate under and make it excellent by fully leveraging that model’s success factors.

Minor customization of standard is possible but draw a line in the sand and stick to it. Know—as a service department—exactly what you will and won’t customize. For example, in a CAS practice, limit yourselves to supporting a tech stack that makes sense for your client base, skill set, and with which you can be most profitable. Don’t try to work across every accounting platform. Departing from the stack consumes resources and erodes margin. To price this work, establish fixed prices (unique to the buyer) stating any appropriate variables as “pre-priced add-ons.”

Minor standardization of custom is possible, but remain flexible and reward and value constant re-invention. Don’t beat people up for innovation time. And don’t ever charge for this high-value work by the hour, base your prices on the worth of the work. Instead of relying on time spent, teach your people how to plan their tailored projects well by creating core templates from which you expect to tailor and depart. And communicate frequently with customers before and during the sale to manage expectations and prevent scope creep. (I teach techniques for this in my “how to price consulting work” course discussed at the bottom of this Advanced Pricing Methods® page).

Avoid straddling that murky middle

We cannot maximize our potential when we operate these distinctly different business models somewhere in the middle without solid commitment to either. If your organization has both, recognize the ways in which they are competing models with different success factors. Don’t plug them both into a single management approach with the same success metrics. Run these distinct business types appropriately and effectively and watch your firm grow.

Recent Comments