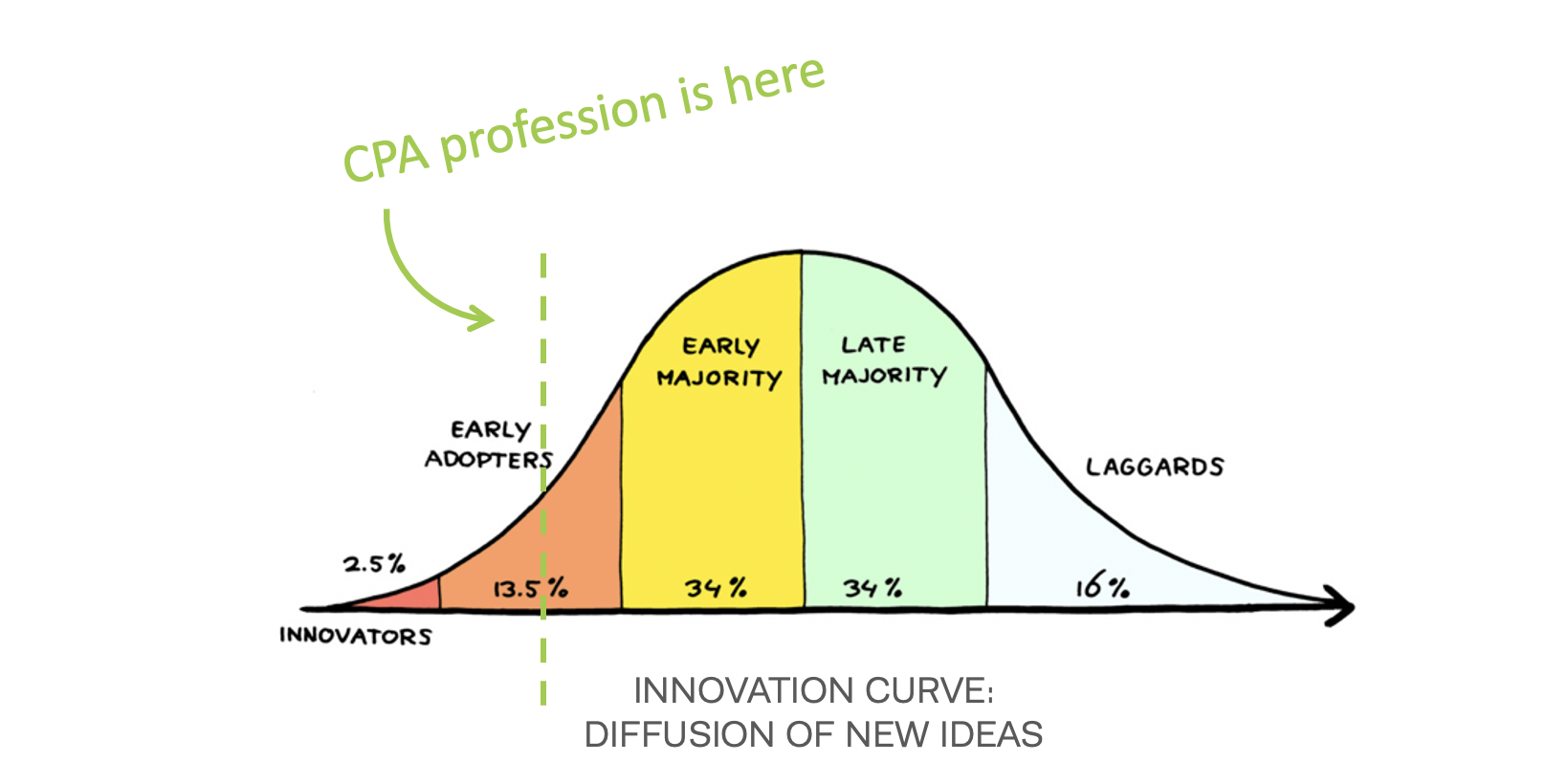

We’re seeing some really big strides in the business (and revenue) model shifts in the accounting profession. At this writing, FIVE of the US Top 100 largest CPA firms, and several Top 200 firms, are currently instituting Fore’s Advanced Pricing Methods℠. These courageous firms represent the front end of the Diffusion of innovations curve: the pace at which new ideas are embraced and adopted (concept by Everett Rogers,1962).

In Changing the Business Model, INSIDE Public Accounting‘s Chris Camara summarizes what’s happening along with my thoughts on why and some steps to get started on changing your own pricing approach.

Here’s a snip (click on article thumbnail for the full piece):

Here’s a snip (click on article thumbnail for the full piece):

Within the last few years, firm leaders have begun accepting that a new revenue model is inevitable, spurred by the rapid introduction of time- saving technologies. Since fewer hours mean reduced WIP-based billings, firm leaders are implementing – or at least investigating – different revenue methods that capture each solution’s worth, not the time spent on it, which is irrelevant as far as the client is concerned.

The impact of work speed on traditional billing is already being felt, says River. One East Coast firm, for example, implemented data analytics and reduced time spent on one aspect of audit from five hours to about 15 minutes. If an hours-X-fee system is used, the time reduction across hundreds of clients means a serious revenue deficit, River says. Another example is an IPA 200 firm that implemented Lean Six Sigma techniques and a workflow product that reduced tax preparation time up to 50% in some cases. Without another revenue model in place first, even after adding clients, they had a $900,000 shortfall between their 2017 and 2018 WIP.

If you’re interested in more “how to” check out my half-day workshop on Nov 5, 2019 in Indianapolis at the 2019 PRIME Symposium. This workshop is open to the public and is limited to 50 guests. Contact prime@plattgroupllc.com for details!

Recent Comments